Report

The Russian Face of the Fashion World

December 2023

The Russian Face of the Fashion World

The apparel and footwear market in Russia saw a 3.5% average annual decline from 2018 to 2022, while the share of affordable fashion in the country grew significantly, reaching 72% (according to the Fashion Consulting Group report, 2023). The online segment became the key driver behind the market's growth, rising from 10% to 32% of the total market over the same period (according to the Fashion Consulting Group report, 2023). In the positive base case, the apparel and footwear market can expand 5-7% in the next five years driven by domestic players’ growth, according to the insights provided by Yakov & Partners experts in their report titled "The Future of Russia’s Fashion Market: Belt-Tightening or Fashion without Borders?"

The Russian apparel and footwear market has been steadily shrinking, with the only period of growth over the past five years being 2021 (according to the Fashion Consulting Group report, 2023), which may be due to the release of post-pandemic pent-up demand. The high-end price segments were put under additional pressure by external factors such as price escalation due to the depreciation of the ruble, restrictions on imports of high-end goods, as well as logistical problems and the departure of a number of international players. All this contributed to the share of the budget segment growing to 72%.

More than 70 major foreign brands, which in 2021 had a share of more than 20% and generated revenue totaling more than RUB 450 bn, have left the Russian market. As the authors of the study note, the current situation has become a crucial development driver for domestic companies.

The share of the top 30 Russian players in terms of revenue has grown from 20 to 35% in five years, facilitated not only by the departure of other players, but also by the right strategy: the key success factors have been an affordable product, a diversified business model, and federal coverage. The business model of marketplaces should be separately highlighted: in 2021–2022, it propelled rapid turnover growth of 35 to 130% depending on the marketplace, which underscores the growing role of online retail in our country.

The share of online sales in the apparel and footwear market in Russia is growing more than twice as fast as in most leading countries: for example, in 2018–2022, annual growth reached 35%, which is on par with Indonesia. As noted in the study, the maximum coverage of the online sales channel in most leading countries was observed during restrictions related to the COVID-19 pandemic and was no more than 41–44%, which suggests a potential room for growth of this channel in Russia, where its coverage in 2022 was about 32%.

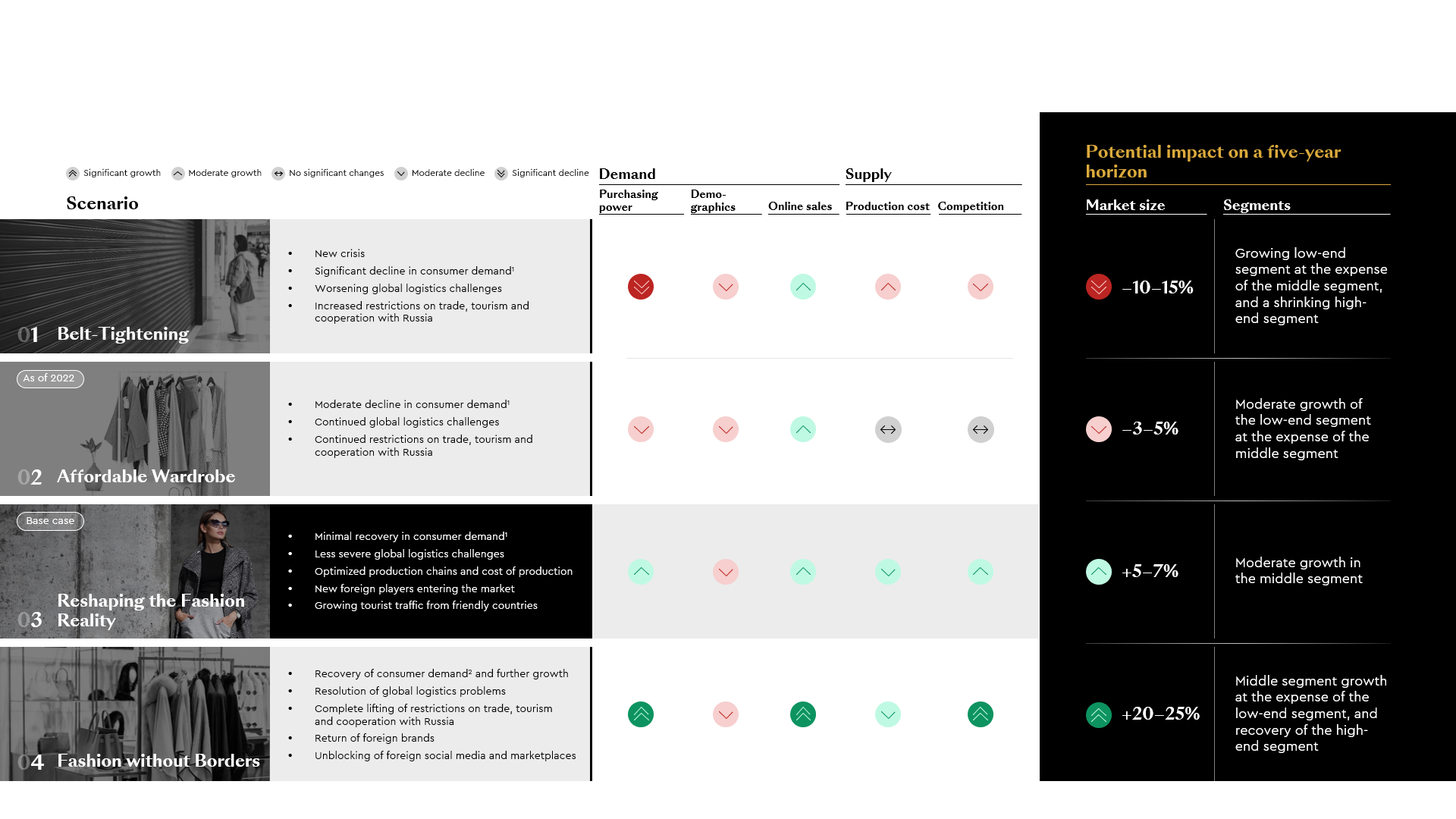

According to the authors of the study, on a five-year horizon, the market in Russia will be exposed to a wide range of transformational changes related to the demographic situation in the country, the purchasing power of the population, and foreign policy factors.

In the positive base case, which assumes minimal recovery in consumer demand, fewer logistics challenges, optimization of production chains and cost of production, as well as the arrival of new foreign players in the market and tourist traffic expansion, growth could reach 5–7% over five years.