Report

Digitalizing Russia’s Agricultural Sector: Challenges and Solutions

August 2023

Digitalizing Russia’s Agricultural Sector: Challenges and Solutions

Russia needs to improve its agricultural efficiency. One powerful way to do that is to ramp up digitalization of the industry.

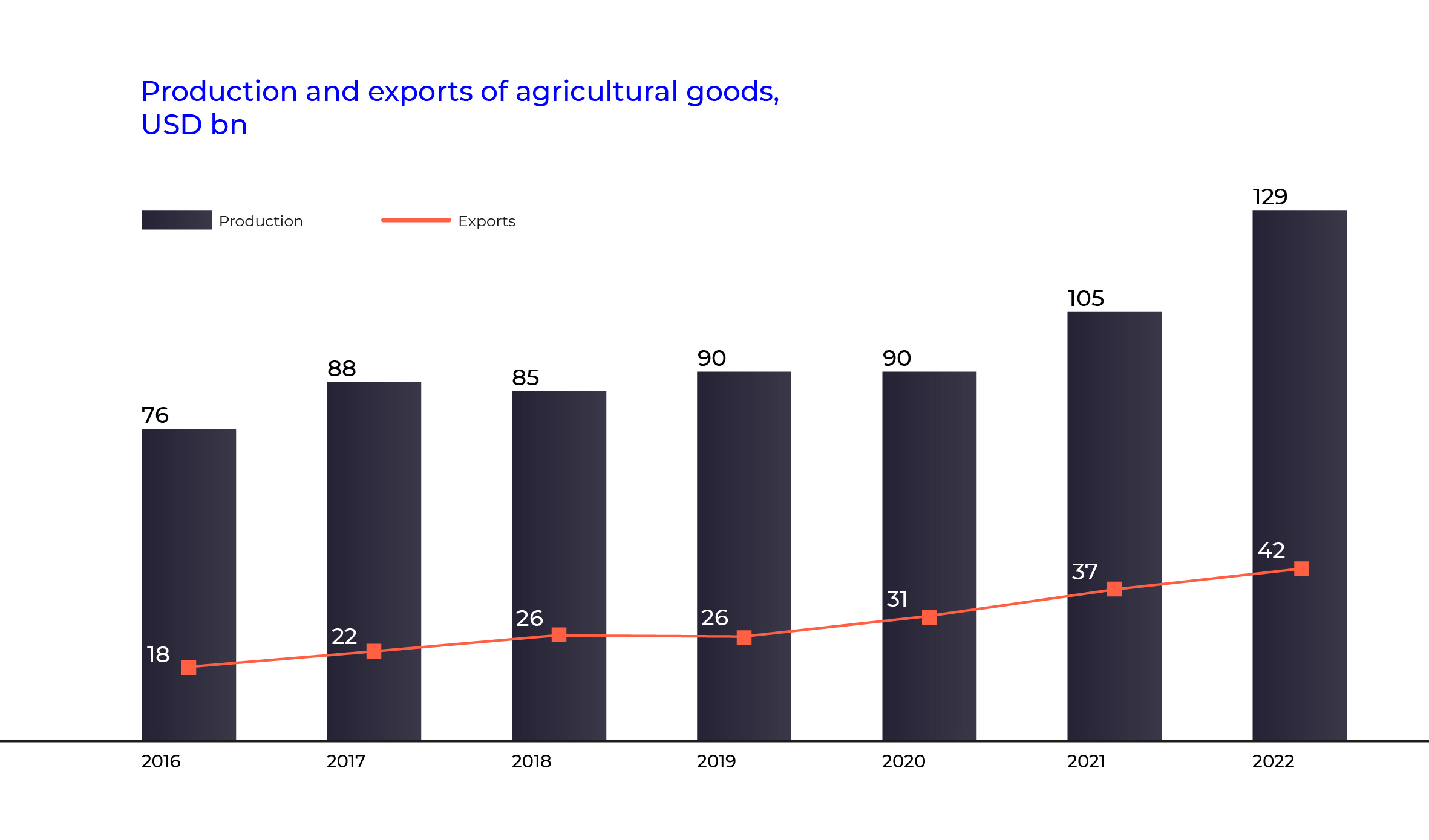

The Russian agricultural sector has been rapidly and successfully developing in the past few years. Between 2016 and today, it ramped up its production by 69%, while exports more than doubled (+134%).

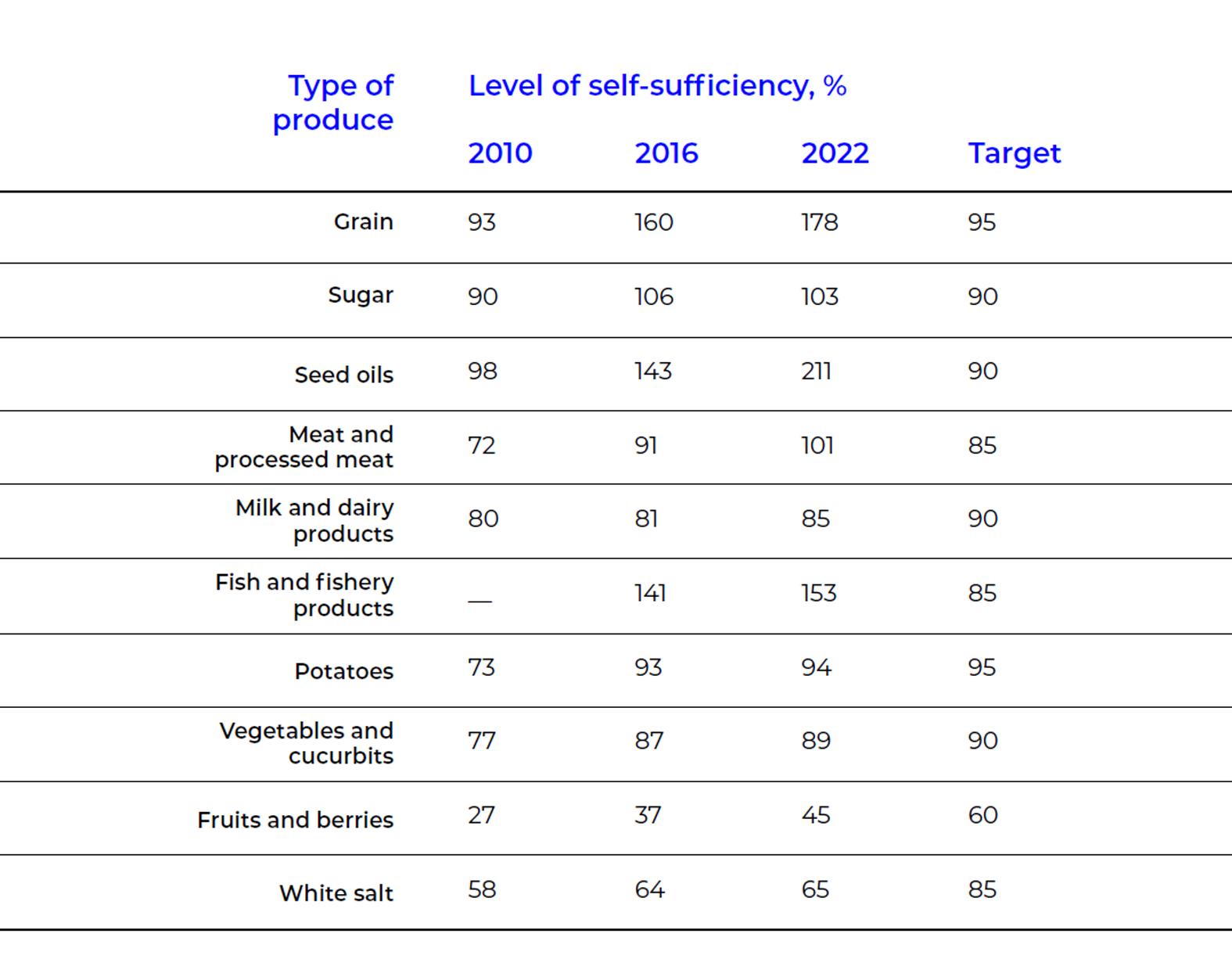

Although Russia is yet to ensure food security, the steady development of its agriculture allowed it to attain self-reliance in food production across a majority of target indicators and even go on to supply food to the rest of the world. As a result, Russia’s food security index rose from 63.8% in 2015 to 73.7% in 2020. Yet those successes were achieved when domestic agricultural players had access to western technology and equipment, and there were no barriers to cash flows.

The sector has already exhausted all the available quick wins

After the February 2022 events, despite the record-breaking harvests of the 2022/2023 season, the food security index of Russia dropped to 69.1%. This can be attributed to several factors, including the rising cost of equipment, slower innovation, supply chain disruptions, and political obstacles.

As the sector has already exhausted all the available quick wins, digitalization is coming to the fore as a way of supercharging further growth.

In terms of digital innovation, the Russian agricultural sector has three distinct features: limited scope of digitalization efforts, lack of digital technology experts at agricultural enterprises, and the focus of the Ministry of Agriculture on controlling industry players rather than stimulating development.

The first one manifests itself in the fact that digitalization is mainly carried out by large vertically integrated agricultural holdings, while small and medium-sized agricultural producers do very little, if any, digitalizing. As a rule, companies focus on selective implementation of out-of-the-box solutions targeting production, rather than processing and sales processes. As digitalization is mainly restricted to those areas of business that entail high operating costs, companies fail to capture the full potential of digital transformations.

Another distinct feature has to do with the fact that Russia lags behind leading countries in terms of the volume and efficiency of its investments in agricultural sciences. Its investments in this area are less than the amounts invested by the USA almost by a factor of 60. At the same time, few universities are focused on training professionals sought-after in the market. According to the National Research University Higher School of Economics, in the decade up to and including 2021, US universities trained almost 2,000 specialists in agricultural genetics, breeding, and reproductive technologies, while Russian universities provided no such training at all.

- an end-to-end information management system;

- lower production costs;

- improved productivity;

- transition to Agriculture 4.0.

Yet, in practice, it’s implementation of tracking systems that turned out to be a priority. This year, farmers will have to account for their results in a number of federal information systems, including "Mercury", "Zerno", and others. Creating a national digital platform that would provide real-time data to guide managerial decisions was put off until 2030.

Global experience shows that digitalization of agriculture has huge potential. For instance, digital technology helped US farmers increase yields by 5–10% and reduce the need for agricultural inputs by 15–20%. Creating digital twins of production processes and supply chains allowed Tyson Foods to increase its net profit by 5% and reduce water consumption by 12%.

Digital technology helped US agriculture players boost yields by 5–10%

These successes encourage global investors to ramp up their investments into this area. According to AgFunder, between 2012 and 2022, private investment in startups that develop digital solutions amounted to USD 196 billion.

In order to objectively assess the Russian agricultural sector in terms of digitalization, as well as to conduct quality benchmarking with leading countries, Yakov & Partners developed a tailored Digitalization Index.

Each indicator was assigned a weight that reflects its contribution to the total extent of digitalization. Using this Digitalization Index, we were able to thoroughly assess the markets under consideration, supplementing our own data with information provided by experts, as well as to conduct both a high-level and in-depth analysis through the lens of individual metrics.

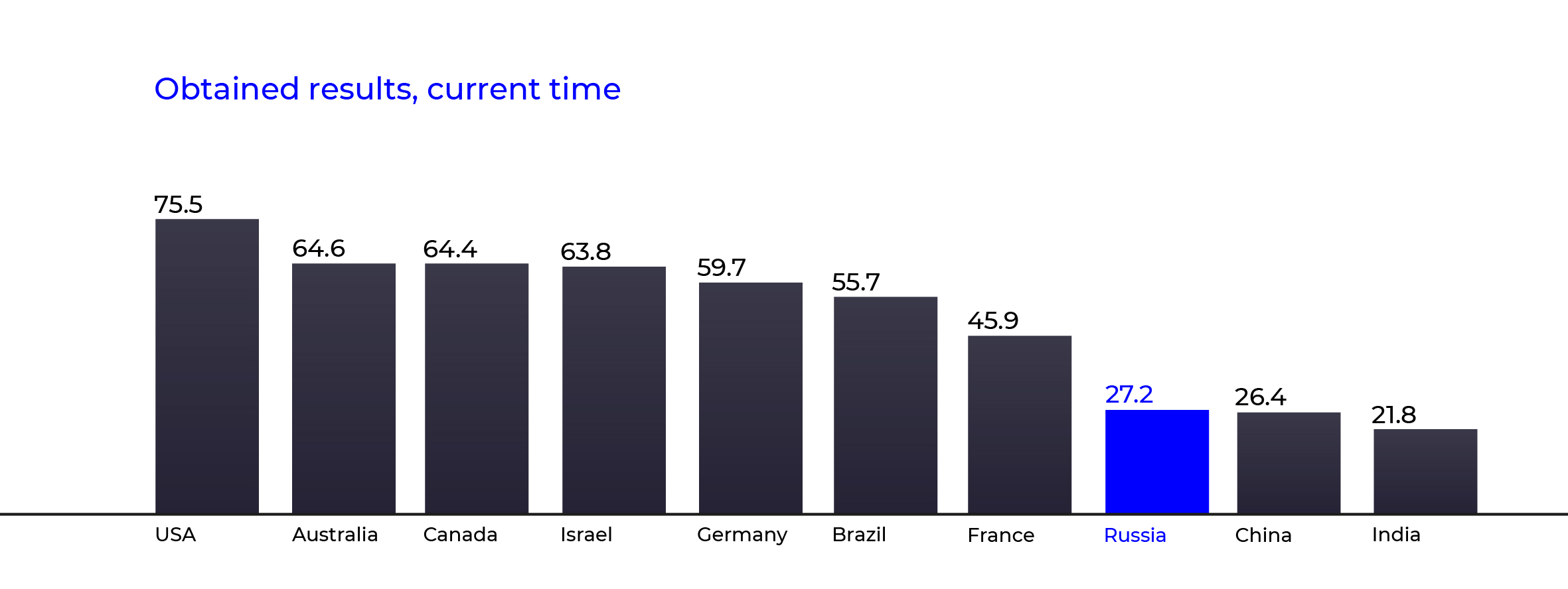

In the course of the study, we compared the situation in the domestic agro-industrial complex with those in other countries, including such recognized industry leaders as the USA, Brazil, Germany, China, France, Canada, India, Australia, and Israel.

The study showed that Russia lags way behind the global leaders in terms of the extent of digitalization of its agricultural sector, as it scored nine times as low as Israel in terms of the level of implementation of digital solutions by agricultural producers; seven times as low as the countries under consideration in terms of the average volume of private investments; and three times as low in terms of the number of companies implementing digital technologies (excluding the USA).

It should be noted that Russia demonstrated a relative parity in terms of infrastructure development, yet this should probably be attributed to the general level of IT development in Russia rather than this specific sector of its economy.

The above peculiarities could keep Russia from capturing its full potential.

Creating a platform for processing and storing data that would guide decision-making

Agroholdings need internal platforms for processing and storing data and making informed decisions. It is necessary to consolidate information flows, create single-window interfaces for employees and increase the transparency of business processes for executives. This will allow companies to make the most out of all available modern data processing technologies.

Data processing and storage platforms, for example, will help agricultural enterprises to utilize data from precision agriculture software to develop logistical processes. Suppose a precision agriculture solution predicts the volume and crops maturity times. Relying on this data, another solution can predict the amount of equipment required for harvesting. Excessive equipment can be rented out, and if there is a shortage, the lacking items can be ordered in time.

API standardization is a vital condition for setting up a single agribusiness management platform

Creating a single anonymous agricultural databank

Чтобы раскрывать потенциал цифровизации в масштабе всего АПК, аграриям нужно не только эффективно использовать свои данные, но и обмениваться ими с другими участниками отрасли.

Unlocking digitalization potential across the entire industry requires that companies are able to both use their data effectively and share it with other industry participants.

For example, access to an anonymized dataset on fields, yields, and crop quality will allow for development of solutions that improve growing efficiency.

This data bank could be operated by the Ministry of Agriculture, which would provide equal access to all interested parties, or a relevant autonomous non-profit organization.

A similar solution has already been implemented in the banking sector upon the initiative of the government as it obligates relevant organizations to submit borrowers’ credit records to at least one credit bureau.

Shifting the focus of the digitalization program of the Ministry of Agriculture

Small and medium-sized players cannot do without government support

These services will facilitate farmers’ access to state support programs and market participants. In return, the government will receive transparent data on the industry.

Service development and implementation should cover three areas along the entire value chain:

- Services to inform decisions related to the agricultural cycle to maximize crop and livestock productivity, climate and weather forecasting, including seasonal climate forecasts and short-term high-resolution weather forecasts, crop and harvest time modeling.

- Solutions enabling equipment rental, short-term employment of people, and direct interaction between equipment suppliers, agricultural producers, and consumers of their produce.

- Tools for information exchange between farmers and the government, financial institutions, and advisory bodies.

In one form or another, such services are already being implemented in a number of friendly countries, and such practices could be adopted in Russia. Their combined use could make it possible to bring together farmers to achieve economies of scale. For example, farmers would be able to conduct joint commercial operations, or rent equipment. Customers would be able to contract farmers to produce stipulated quantities at fixed prices, which would benefit all the parties involved.

We estimate that by 2030, digitalization could boost labor productivity in the Russian agricultural sector by 15.6% (cumulative total), increase production volumes by 3 to 5% depending on the type of enterprise, reduce production costs by 5 to 20%, and generate an additional RUB 800 billion annually.

Agriculture digitalization could generate an additional RUB 800 bn per year by 2030

Thus, successful development of the Russian agro-industrial complex will crucially depend on the results of digitalization measures and, in particular, on the government policy in this area.

1 The 11th Global Food Security Index shows a deterioration in the global food environment for the third year, threatening food security.