Article

Who will benefit from digital rubles?

February 2024

Who will benefit from digital rubles?

328 bn rubles p.a. – expected total economic impact for the B2B sector with the realization of the full potential from DR adoption in Russia

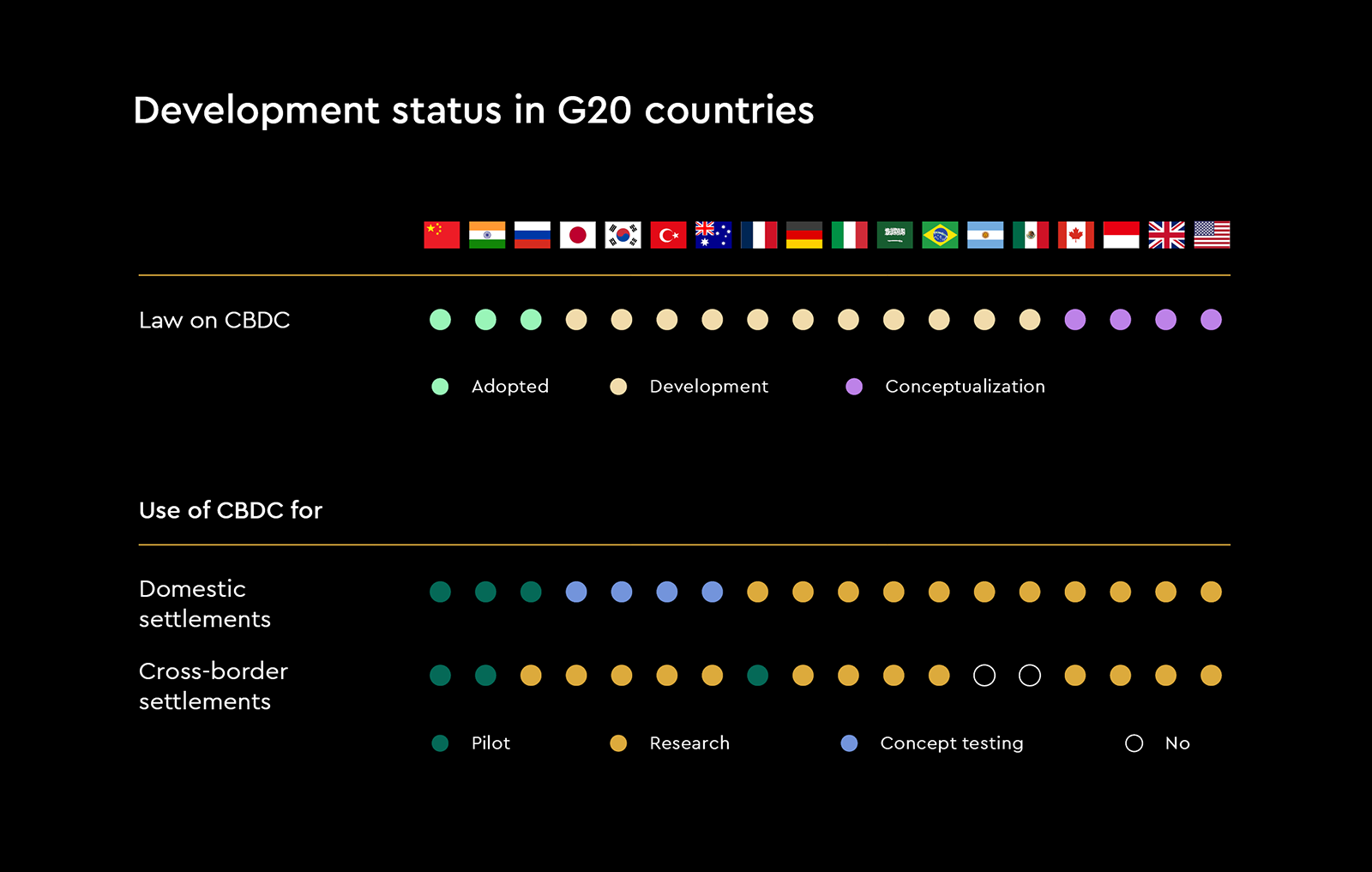

Since August 1 last year, the digital ruble (DR) in Russia has become a reality and moved into the pilot testing phase, confirming Russia's leadership in the development of this instrument along with China and India, both actively integrating central bank digital currencies (CBDCs) into their economies.

Yakov and Partners Finance practice has undertaken a comprehensive analysis of the potential for DR adoption. Part 1 of the analysis¹ focused on the use of digital currency and other innovations in retail payments. The current study focuses on the potential that DR technologies offer for the B2B sector.

Our calculations show that unlocking the full potential of DR adoption in Russia may generate up to RUB 328 bn annually in total economic benefits for the B2B sector. This will require proactive and coordinated efforts by Russia's Central Bank, businesses and the banking community, as well as comprehensive regulatory and integration measures at the national and international levels. The players to benefit from the transition to the new technology and new scenarios in the future will be those that are first to adopt the most profitable scenarios in the best possible way. Businesses will choose those banks that will give them a new earning/saving tool.

The background to various central banks' interest in digital currencies were the trends that became evident in the early twenties of this century.

One of them is the growth of non-cash payments and the emerging

habit of paying this way among the population and businesses.

In some countries, the share of cashless transactions is approaching

100%: for example, in Norway it reaches 97%.² Russia is also going

in this direction: in 2023, the share of non-cash payments was 84%,³ showing a 1.6-fold growth over the last five years.

Another trend that has prompted national central banks to start

developing CBDCs has been a growing interest in private digital

assets. According to the European Central Bank, up to 10%

of households in six large EU countries already own digital assets,⁴ in the UK 10% of adults have cryptocurrency experience, while 22%

of respondents in India, 20% in Brazil, and 14% in the US report that

digital assets are part of their financial portfolio.⁵

In 2023, the share of non-cash payments in Russia was 84%, showing a 1.6-fold growth over the last five years

The growing interest of business and society in digitalization and the use of digital technologies in the financial sector, which, among other things, enable greater control over the flow of funds, have provided an additional impetus for central banks.

In addition, central bank digital currencies represent another step towards further improving the ease of settlements and the speed of financial transactions.

Along with cash and non-cash assets, central bank digital currencies are a third form of national currencies that complements and augments the capabilities of the first two.

- The main benefits of CBDCs are efficiency and speed of payments, security and transparency of transactions, strengthened monetary sovereignty, reduced dependence on private payment systems, and enhanced access to financial services. In addition, CBDCs facilitate the integration of the digital economy into everyday practices by simplifying digital payments, and drive the development of new financial products and services. Unlike cryptocurrencies, CBDCs are underwritten by states and their regulators, which guarantees the stability and reliability of CBDCs.

- The DR is the third form of national currency of the Russian Federation, which is regulated and controlled by the Central Bank of Russia, while commercial banks and other financial institutions participate in its distribution and servicing. The main function of the DR in the economy is to serve as a new and convenient tool for payments and transfers, rather than as a savings instrument: DRs do not accrue interest on the balance or cashback on payments.

The development of blockchain technology and its successful

deployment in creating cryptocurrencies have provided central banks

with a unique tool for solving problems – both their own problems

and those that the market faces. Today, 130 countries representing

98% of the world economy have already started developing digital

versions of their national currencies.⁶

Today, 130 countries representing 98% of the world economy have already started developing digital versions of their national currencies

By early 2024, Russia, along with China and India, has emerged as one of the leaders that have been able to move digital currency practices into the realm of current law and have made significant progress in developing their digital currencies. These countries are currently exploring and piloting both domestic and cross-border digital currency transactions.

Russia's DR platform was put into commercial operation as part of pilot testing. On August 1, 2023, a federal law establishing the legal framework for the DR came into force. The Bank of Russia, which acts as the platform operator, is working to integrate the new currency into the country's economic system. Thirteen major Russian banks are involved in testing the DR, and 17 more banks will join them in 2024. Phase 2, in 2025–2027, will involve massive introduction of the DR into economic practices. Learning from the experience of China and India, where national central banks are piloting international transactions using CBDCs, a logical next step in the CBDC evolution in Russia would be to launch a pilot DR project for international transfers.

It should be noted that the first practical steps in this direction have been made: one of the largest banks has already presented a prototype system for cross-border B2B transfers in DR from Russia to Belarus.

Another important feature: many beneficiaries, including business

people, in countries that have been successfully moving towards

the introduction of national digital currencies were wary of the

new product before the start of the new project and even during

its implementation. For example, 34% of respondents in a global

survey were against the launch of a digital currency in their countries.⁷ A similar trend can be observed in Russia: according to VTsIOM, 70%

of Russians are aware of the introduction of the DR, but only 30%

would like to use it, with every second respondent unable to answer

the question about the purpose of digital currency introduction.⁸ More than 65% of Russian companies still do not see the benefits of the

DR for their business, and almost as many do not understand how

to use the new form of money. The main concerns in Russia, as in other

countries, are related to stronger government control over the flow

of money, as well as a lack of knowledge about the benefits of the DR.⁹

More than 65% of Russian companies still do not see the benefits of the DR for their business, and almost as many do not understand how to use the new form of money

In other words, many market players need considerable time to articulate the benefits and advantages of using the DR, despite the significant rewards it can bring when fully implemented. To a large extent, this situation is due to underwhelming efforts to popularize the DR and raise awareness of its benefits among market players. Another factor is the current lack of a wide range of DR-based financial instruments.

The degree of DR penetration into the economy is directly related to how active the players are in the process of its adoption and development. In the project context, there are two possible scenarios that will determine the scope of the economic impact.

Best-case scenario

The Central Bank, the banking sector and businesses work together to promote DR dissemination and adoption by taking active steps to integrate the digital currency into existing financial products and investing in the development of new products based on it.

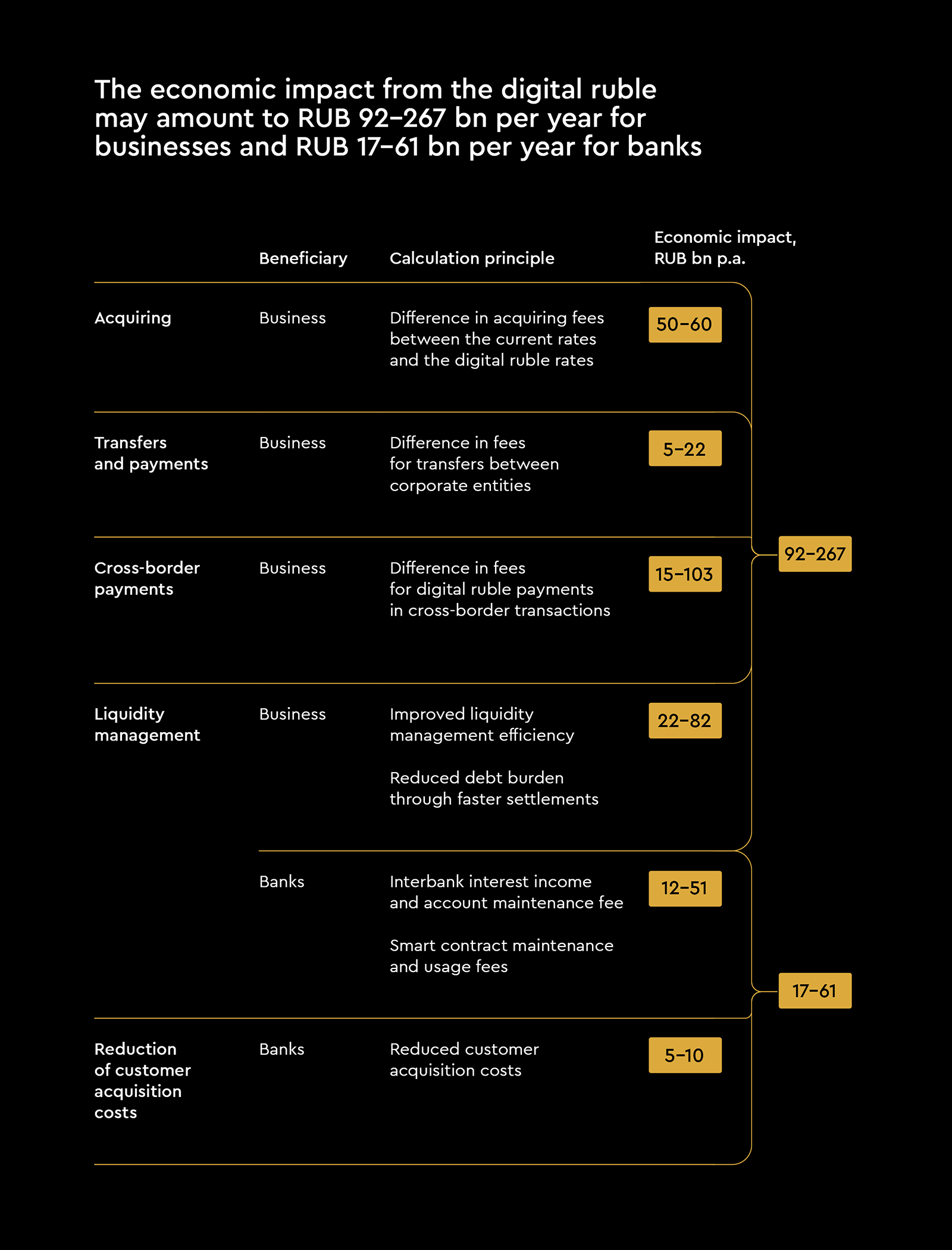

In the best-case scenario, the impact will be up to RUB 267 bn per year for businesses and up to RUB 61 bn per year for banks. The total impact will be up to RUB 328 bn annually.

Conservative scenario

The Central Bank limits itself to a minimal project scope without active promotion, while banks and businesses focus solely on meeting regulatory requirements.

The conservative scenario will have a smaller, but still significant impact – RUB 92 bn per year for businesses and RUB 17 bn per year for banks. The total impact for businesses and banks in the conservative scenario will be about RUB 109 bn.

In all scenarios, DR adoption will have a significant impact on the Russian economy. In any scenario, we expect that companies that will be the first and most efficient in integrating digital currencies into their processes will emerge as the market leaders. These organizations will be the main beneficiaries.

Reduced fees for payments and transfers improve business margins

The retail sector is an important beneficiary of the DR, with

significant savings on acquiring fees. Reducing the acquiring

fee to 0.3% when paying with the DR could bring an economic

benefit of up to RUB 50–60 bn a year. In retail, where the benefits

are obvious, DR development dynamics may be close to those of the

Faster Payments System (FPS), if the service is actively promoted,

customer journeys are optimized, and banks and retailers work

together. In this case, the DR will replicate the success of the FPS,¹⁰ with QR code payments in retail reaching RUB 1.7 tn in the last

12 months. It can therefore be assumed that DR payments in retail will

reach about RUB 4 tn per year in the third to fifth year after launch.

In addition, the economic impact of low fees and high speed

of DR transfers can reach RUB 5–22 bn due to another factor – savings

on fees for transfers and payments between corporate entities. The

amount of such transactions in 2022 amounted to RUB 1.3 sextillion,¹¹ and the number of transfers reached almost 9 bn. Currently, the bank

fee for transfer orders ranges from RUB 20 to 200, and the execution

time varies from a few minutes within one bank to several hours for

interbank transactions. The DR is both faster and more cost-effective:

transfers are instantaneous, and the transfer fee will be RUB 15 from

2025.¹² If the DR takes up 20–40% of business transactions, the

economic impact in this area alone could reach RUB 5–22 bn in the

fifth year of implementation. Instant cheap transfers between

corporate entities will be another factor incentivizing companies

to utilize the DR.

Reducing the acquiring fee to 0.3% for DR payments could bring an economic benefit of up to RUB 50–60 bn a year

In addition, the DR offers significant advantages in corporate finance management. In particular, its integration on the CBR platform expands the opportunities for businesses to conduct transactions such as cash pooling, short-term or overnight deposits, and smart contracts.

Cash pooling

Cash pooling is a liquidity management tool for optimizing cash management in large companies with multiple subsidiaries. It is based on combining the balances of several accounts belonging to different structural units into one centralized pool, which facilitates efficient distribution of liquidity, reducing the overall need for external financing and optimizing interest expenses.

Today only major companies (such as Gazprom,¹³ SUEK,¹⁴ Tatneft¹⁵)

launch cash pooling projects in Russia, and the product itself mainly

remains the domain of systemically important banks that traditionally

serve large corporations. A single DR platform creates the basis for

a more flexible mechanism with quick movement and placement

of funds in different banks, which will increase the availability of cash

pooling instruments for medium-sized companies.

Smart contracts

These are programs that automatically execute the terms of a blockchain-based contract. Smart

contracts offer significant opportunities for optimizing corporate finance, including both complex

cases, such as automating cash pooling transactions and efficient liquidity management, and

simpler ones, such as automatically calculating and remitting VAT to the tax authorities when

payment for goods is received. According to the CFA Institute Global Survey on Central Bank

Digital Currencies,¹⁶ this technology is sought after by almost half of business respondents, and

China, India, and the UAE see smart contracts as one of the main levers for digital currency

adoption, anticipating their high popularity in financial transactions.

The benefits of the DR in terms of liquidity management significantly expand the list of those who will gain from its adoption. In addition to a wide range of large corporate entities from different business sectors, small and medium-sized companies will be able to use the instrument. Digital liquidity management products are expected to provide an easy, clear, and simple access to managing funds in accounts with different banks, placing funds on short-term or overnight deposits.

Optimizing corporate finance management using the DR could potentially bring businesses an economic benefit of RUB 22–82 bn per year and could serve as a basis for passing on some of the benefits that retailers will receive from the DR to consumers – for example, via loyalty programs.

51 bn rubles per year – expected fee income that corporate finance management optimization can bring lending organizations through cash pooling and smart contracts

Reduced fees for transfers and payments with the introduction of the digital ruble will spur competition and open up new opportunities for banks

It is important to note that the more aggressively the DR is introduced, the more radically banks are deprived of their leading role in the payments and transfers market, and therefore of considerable fee incomes from B2B transactions.

On the other hand, the emergence of the DR will drive competition in the banking sector. This will require banks to adapt to the new environment, including integration of new technologies, development of innovative products and services to retain their market share and make up for losses.

One opportunity is to expand the customer base and reduce the cost of customer acquisition through tracking, which is technically feasible on the DR platform. Since the digital wallet will be added to all banks of the customer, financial institutions will be able to use the DR platform as a showcase for targeted, and low-cost, acquisition of new customers. Considering that now the average SME customer acquisition cost is about RUB 20,000, the acquisition cost reduction through the DR could range from 30% to 50% per customer, covering 20% to 40% of the new customer base. The economic impact for banks may amount to RUB 5–10 bn per year.

Transaction tracking allows customers to track the progress of digital payments and transfers

Another promising niche is reducing the costs of interbank transfers. The third form of the ruble may allow banks to reduce the costs of maintaining payment and transfer infrastructure by utilizing the Central Bank's infrastructure.

Optimization of corporate finance management through cash pooling and smart contracts will be beneficial not only for companies, but also for banks: it can bring lending organizations another RUB 12–51 bn per year from fee income generated by new products.

Unlocking the above potential will require designing a detailed mechanism of interaction between the DR e-wallets and the banking infrastructure and a wide range of financial products, as well as developing privacy hierarchies and data access levels.

In the context of the continuing decline in the number of Russian banks connected to the SWIFT system, which traditionally served as the basis for international bank transfers, there is a need to develop alternative mechanisms for cross-border payments. In this regard, the DR is a possible solution to the problem that can help mitigate the impact of financial restrictions.

From a technology perspective, the DR represents a new and efficient vehicle for international settlements. For example, various options for its use include the creation of a single digital currency of the BRICS countries and exchanges between national digital currencies. According to our estimates, the potential economic impact of the DR in cross-border transfers, provided that it reaches a turnover of 1–5% in foreign trade, could be between RUB 15 and 103 bn per year, owing to fewer intermediaries and higher transaction speeds. The benefits from cross-border transfers through the DR platform will be shared between business and the banking community.

Potential economic impact of the DR in cross-border transfers could be between RUB 15 and 103 bn per year

Key advantages of cross-border transfers using CBDCs

- Direct transactions. Unlike conventional systems, where cross-border payments usually require multiple intermediaries, CBDCs enable direct transfers between countries without correspondent banks and other transfer parties. This significantly reduces payment processing time.

- Cost reduction. Traditional international transfers are often associated with high fees and hidden costs. CBDCs lower the overall costs of cross-border transfers by reducing transfer and FX fees.

- Transaction speed. In traditional systems, cross-border payments can take several days to weeks. CBDCs provide a significantly higher speed through automated processing and the absence of manual checks at each step.

A necessary element in enabling large-scale DR use in cross-border transfers is a wholesale digital currency model that makes it possible for entire financial institutions and countries to conduct transactions.

Wholesale CBDC model

A system for use in interbank and financial transactions at the corporate level. This model differs from the retail model in that it focuses on large financial institutions and corporations. In this model, CBDCs are used to simplify and speed up interbank settlements, improve liquidity and risk management, including clearing and settlement between banks, securities trading, and other large transactions.

The introduction of the wholesale model is a step that makes Russia's participation in international cross-border projects technically feasible. For example, the mBridge project, in which China, Thailand, the UAE, and Hong Kong are already participating with their national digital currencies, while India and the UAE are considering direct digital currency exchanges and transfers.

In addition to solving technological problems, Russia will have to address a number of other issues in order to launch efficient cross-border settlements in digital currencies. These include balancing liquidity mechanisms between countries, developing the legislative framework, entering into intergovernmental agreements, and coordinating between central banks.

In the chosen model of digital currency development, much depends on the Central Bank: building technological and legislative infrastructure, coordinating market players, and popularizing the DR among households and businesses. What steps would it make sense for the regulator to consider in order to strive for the best-case scenario with a massive economic impact?

Since the target audiences are not sufficiently aware of the possibilities offered by the DR, a strong awareness-raising campaign is needed to promote the DR across Russia and build knowledge of its benefits. Such a campaign should cause businesses to stop being wary of the third form of the ruble, become interested in its opportunities, and move on to practical testing of the new instrument. Given the status of the platform operator, the Central Bank of Russia is expected to spearhead such a campaign, but for it to be successful, leading Russian banks must be actively involved.

The objective of Level 2 of the awareness campaign – offering new DR-enabled instruments to business by banks – is also impossible to achieve without the active participation of the Central Bank of Russia. For such promotion, liquidity management tools are seen as the most beneficial for banks and the most useful for customers.

Development and integration of new instruments in terms of both technical capabilities and regulatory framework (for example, the CBR will have to create/define rules for implementing special repositories to regulate smart contracts) will, not doubt, also be required. In general, DR development for business – establishing a set of detailed regulatory rules, including limits for corporate entities that are yet to be announced – remains the most important task. Once this task is completed, it will create an infrastructure for seamless integration of the DR into the Russian business environment.

The objective of creating new DR-enabled instruments for business by banks cannot be achieved without the active participation of the Central Bank

Creating comfortable DR customer journeys is no less important than expanding knowledge about it. It should be easy and convenient for users – both private individuals and corporate entities – to work with the DR from the outset, rather than after multiple refinements. The "first date" with an innovation is crucial. To ensure that the customer decides in favor of the new product and not against it, the Central Bank and banks need to work together, taking into account already completed peer projects.

Finally, a successful comprehensive solution to the challenges mentioned above opens up opportunities for the Central Bank's initiatives to expand the DR’s impact on the economy – incorporating it into government payments (subsidies, government contracts, etc.).

DR deployment represents an additional challenge for the Bank of Russia and commercial banks not only from the organizational perspective (new equipment and special software, new business scenarios and human resources will be required), but also in terms of direct financial costs. However, relative to the possible benefits, the costs are many times lower.

The cost of building infrastructure to provide cyber resilience for the DR was estimated at RUB 20–25 bn at the outset of the project in 2020, while the intensity and complexity of cyber threats have dramatically increased since then.¹⁷

A bank will have to spend an average of RUB 200–300 mln on DR adoption

The banking community's total costs (it is assumed that 100 to 200

lending institutions will participate in the DR project) can be estimated

at RUB 30–50 bn (taking into account cybersecurity costs). In this

case, each bank will have to spend an average of RUB 200–300 mln.

For example, one of the banks involved in the pilot project has

already invested RUB 150 mln in DR adoption, with the bulk of the

expenditures going into building information security infrastructure

and a gateway with the Central Bank.¹⁸ For larger banks, this figure

may be several times higher. Such costs for the banking sector, which

at the end of last year posted a record profit of over RUB 3 tn, look

quite reasonable. However, considering that profit is concentrated

mainly in the country's largest banks, the costs for a particular lending

institution may become quite substantial, especially if the bank has

not previously invested meaningful resources in similar technological

projects and expertise.

Recouping RUB 30–50 bn in costs will require banks to actively integrate the DR and offer innovative products based on it, which will make it possible to meet the best-case scenario targets, meaning that the benefits will be many times greater than the costs.

50 bn rubles – estimate of the banking community's total costs of DR adoption

The DR is a major step forward in the development of the financial technology, which promises a powerful evolution of the banking experience in both the retail and corporate sectors. Given its potential for acquiring, transactions, and the use of smart contracts, the DR could generate economic benefits of up to RUB 267 bn per year for businesses and RUB 61 bn per year for banks. In addition, the DR can bring about more efficient financial management, lower transaction costs, and faster payment processing.

The DR could generate economic benefits of up to RUB 267 bn per year for businesses and RUB 61 bn per year for banks

The DR opens up promising prospects for the development of the digital economy: businesses and organizations that are first to pursue the best scenarios will win. At the same time, the Central Bank and banks bear the brunt of the responsibility for realizing the potential, as they need not only to make significant investments, but also to be proactive and work through all aspects of digital currency adoption as quickly as possible. Unlocking the full potential of the DR requires active collaboration between the Central Bank, the government, banks, and businesses. Otherwise, the total annual impact for businesses and banks may be 2.9–3.5 times lower.

The work required to achieve optimal rather than partial economic impact also includes developing and optimizing customer journeys, promoting the new financial instrument and integrating it into existing financial systems. In addition, numerous regulatory and compliance issues need to be addressed, especially in the context of cross-border payments and the use of smart contracts.

The actions of market players in developing new customer scenarios

are largely constrained by the fact that the DR is still in pilot mode,

which may last until 2025.¹⁹ The lengthy pilot phase is understandable,

but delays the widespread adoption of the national digital currency.

At the same time, the significant economic impact for households

and businesses may encourage certain banks to take the lead

in DR implementation and become the main beneficiaries of the

technology through their exclusive status.

Links

1 https://yakov.partners/publications/the-future-of-payment-systems/

2 https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-central-bank-digital-currency-cbdc

3 https://www.vedomosti.ru/economics/news/2023/12/04/1009254-dolya-beznalichnih-platezhei-sostavit-84

4 https://www.ecb.europa.eu/pub/financial-stability/fsr/special/html/ecb.fsrart202205_02~1cc6b111b4.en.html

5 https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/the%202022%20 mckinsey%20global%20payments%20report/the-2022-mckinsey-global-payments-report.pdf

6 https://www.reuters.com/markets/currencies/study-shows-130-countries-exploring-central-bank-digitalcurrencies- 2023-06-28/

7 https://rpc.cfainstitute.org/-/media/documents/survey/CBDC_Survey_Report_Online.pdf

8 https://wciom.ru/analytical-reviews/analiticheskii-obzor/vstrechaem-cifrovoi-rubl

9 https://www.forbes.ru/svoi-biznes/493580-v-bol-sinstve-rossijskih-kompanij-ne-vidat-pol-zu-cifrovogo-rubla-dlabiznesa

10 https://cbr.ru/analytics/nps/sbp/3_2023/

11 https://www.cbr.ru/statistics/nps/psrf

12 https://www.cbr.ru/fintech/dr/doc_dr/tarif/dr_t-1/

13 https://www.gazprom.ru/press/news/reports/2011/kruglov-cash-pooling/

14 https://www.gazprombank.ru/press/6315551/

15 https://www.tatneft.ru/uploads/publications/63ad35722e0b8939200037.pdf

16 https://rpc.cfainstitute.org/-/media/documents/survey/CBDC_Survey_Report_Online.pdf

17 https://www.rbc.ru/finances/03/12/2020/5fc784d29a79478cbf802b14

18 https://www.vedomosti.ru/finance/articles/2023/09/30/998048-rosbank-raskril-summu-vlozhenii/

19 https://www.kommersant.ru/doc/6466071?from=top_main_7